By David Snowball

Updates

The 2018 Thomas Reuters Lipper Fund Awards have been announced. By their calculation, the top fund families overall are Thrivent Mutual Funds and TIAA Investments. Thrivent represents the universe of small fund companies while TIAA represents large firms. The top small fund families were PRIMECAP (equities), Ashmore (fixed income) and Allianz Global Investors (mixed assets).

Individual funds worth noting i nclude Artisan High Income (top high income fund over three years), DoubleLine Shiller Enhanced CAPE (top LCV over three years), and Towle Deep Value Fund (top SCV over three).

nclude Artisan High Income (top high income fund over three years), DoubleLine Shiller Enhanced CAPE (top LCV over three years), and Towle Deep Value Fund (top SCV over three).

Longboard Alternative Growth Fund (LONAX) underwent a -1-for-4 reverse share split on February 23, 2018. In general, such moves are (1) rare and (2) window-dressing. Not to be outdone, Direxion Daily Technology Bear 3X Shares, Direxion Daily Energy Bear 3X Shares, Direxion Daily MSCI Emerging Markets Bear 3X Shares, Direxion Daily S&P Biotech Bear 3X Shares and the Direxion Daily FTSE China Bear 3X Shares all announced on February 28, 2018, reverse splits of 5:1 or 10:1.

Mirae Asset Global Investments is buying the Global X Funds for an undisclosed sum. At $10 billion, Global X is a tiny player in the ETF industry. At $120 billion, Mirae is still no more than a mid-sized one. The Global X ETFs, which will continue being sold under the Global X name, mostly occupy weird little niches: the Founder-Run Companies ETF (BOSS), the Guru Index ETF (GURU), the Lithium& Battery Tech ETF (LIT), the Scientific Beta ETF (SCIU) and so on.

Thomas Kirchner launched the Pennsylvania Avenue Event-Driven Fund (PAEDX) in 2003. We were impressed by him and the fund, and long-ago profiled them. Frustrated by his inability to raise assets, in June 2010 it became the Quaker Event Arbitrage Fund (QEAAX). Despite being remarkably good (top 10% over the past decade, for example), the fund still hasn’t drawn assets. In another reboot, Mr. Kirchner and his co-manager have filed to reorganize the fund as the Camelot Event Driven Fund. While we regret the fund’s ongoing sales fee (a 5.5% front load) and high expenses (1.99% e.r.), we have faith in his ability and best wishes for his success.

Briefly Noted . . .

SMALL WINS FOR INVESTORS

I’ve seen nothing, except the endless trickle of four or five basis point reductions in management fees. While they qualify as better than nothing, they really do strike me as terrified, grudging and impotent gestures. On a $1,000 investment, for example, a three basis point reduction saves the investor $0.30 per year. If you’re doing this in response to the fact that your industry is being ground into irrelevance, you’re apt to be sorely disappointed about how much loyalty thirty cents will buy you. And if you blind yourself to the need for a more fundamental rethinking (“Hey, we cut our fees to the bone! What more could they ask of us?”), you’re likely to end up in a minor niche business.

Had I mentioned that you could still buy hand copied book manuscripts in England in the 19th century. Right, 400 years after Gutenberg people were still making a living by hand copying entire books for rich eccentrics.

Okay, here’s a last minute find of The Shadow’s: the investment minimums for the Zevenbergen Funds’ Institutional Classes will decrease from $250,000 to $50,000. The funds in question are Zevenbergen Growth Fund (ZVNIX) and Zevenbergen Genea Fund (ZVGIX).

CLOSINGS (and related inconveniences)

Davis Funds has closed Class T shares for Davis New York Venture Fund (DNVTX), effective immediately.

Effective April 13, 2018, Eaton Vance Atlanta Capital SMID-Cap Fund (EAASX) will discontinue all sales of its shares to new qualified retirement plans.

Effective February 2, 2018, Fidelity Small Cap Growth Fund (FCPGX) closed to new investors. Only time will tell whether closing a small cap fund at $4.3 billion was too late.

Goodwood SMID Long/Short Fund (GAMAX) has closed its Advisor Class shares and will liquidate them on April 23, 2018.

OLD WINE, NEW BOTTLES

On April 20, 2018 Columbia U.S. Government Mortgage Fund becomes Columbia Quality Income Fund.

Cognios Market Neutral Large Cap Fund (COGIX) is being reorganized as a newly created series of M3Sixty Funds Trust.

Effective on or about February 26, 2018, the name of Pax Ellevate Global Women’s Index Fund (PXWEX) will change to Pax Ellevate Global Women’s Leadership Fund. At that same time, the advisor will waive another 10 bps of their management fee.

Effective April 27, 2018, PIMCO is changing the name of its Class P shares to Class I-2 shares. “P” designates the more expensive of PIMCO’s two institutional share classes: a $1 million minimum like “Institutional,” but about 10 bps higher expenses.

Putnam has decided to terminate one of its more interesting experiments. In 2009, Putnam tried to turn about their failing fortunes – roughly speaking, their funds sucked and investors had noticed – with the launch of their Absolute Return series, which was accompanied by a full media onslaught. The basic story was this: each fund would target a return of cash plus a certain number of basis points, so Absolute Return 100 hoped for returns 100 bps (or 1% annually) above what you could get with T-bills.

Putnam has decided to terminate one of its more interesting experiments. In 2009, Putnam tried to turn about their failing fortunes – roughly speaking, their funds sucked and investors had noticed – with the launch of their Absolute Return series, which was accompanied by a full media onslaught. The basic story was this: each fund would target a return of cash plus a certain number of basis points, so Absolute Return 100 hoped for returns 100 bps (or 1% annually) above what you could get with T-bills.

Putnam recently announced a plan to change the funds’ names, goals, and investment strategies … and, by the way, to eliminate the use of performance fees. Here’s the short version:

Putnam Absolute Return 100 (PARTX) becomes Putnam Short Duration Bond and dreams of “as high a rate of current income as Putnam Management believes is consistent with preservation of capital.”

Putnam Absolute Return 300 Fund (PTRNX) becomes Putnam Fixed Income Absolute Return Fund, “seeking positive total return” (unlike the rest of us).

Putnam Absolute Return 500 Fund (PJMDX) will merge into Putnam Absolute Return 700 Fund (PDMAX), which then becomes Putnam Multi-Asset Absolute Return Fund. While AR 700 was “seeking to earn a positive total return that exceeds the return on U.S. Treasury bills by 700 basis points (or 7.00%) on an annualized basis over a reasonable period of time (generally at least three years or more) regardless of market conditions,” the new version just hopes for “positive total return.”

They’re a hard bunch to judge. Morningstar gives them between two and four stars but that’s a judgment against a peer group (nontraditional bond or multialternative) and not against their self-declared mission. Except for a few share classes of AR 100, the funds were not able to hang out the “mission accomplished” banner.

Here’s the data. The “target return” is Putnam’s calculation of what cash plus 100/300/500/700 would have come to from the funds’ inception through February 2018. Each fund has nine share classes, so the “actual return” is the range of the worst- to best-performing share classes.

| Fund |

Target return |

Actual return |

| AR 100 |

1.24% |

0.7 – 1.7% |

| AR 300 |

3.24% |

1.8 – 2.8% |

| AR 500 |

5.24% |

3.0 – 4.3% |

| AR 700 |

7.24% |

3.2 – 4.8% |

The changes occur on April 30, 2018 but Putnam believes that the portfolio transition, in June 2018, will involve portfolio makeovers with the prospect of attendant transaction costs and short-term taxable distributions.

John Rekenthaler offered a thoughtful eulogy for Putnam, the funds and the “absolute return” category (“Why Putnam has struggled with its absolute return funds,” 2/2/18). He graciously allows, “I would not go so far as to call absolute return funds ‘absolute nonsense’ (a phrase that I also once used for the group, but I have become more moderate with age). However, I remain unconvinced.”

Putnam Multi-Cap Value Fund is becoming Putnam Sustainable Future Fund on March 19, 2018. The goal remains long-term capital appreciation but will invest in “growth stocks of mid-size companies whose products and services we believe provide solutions that directly contribute to sustainable social, environmental and economic development.”

Effective on or about April 25, 2018, the name of the REX VolMAXXTM Long VIX Weekly Futures Strategy ETF (VMAX) will change to REX VolMAXXTM Long VIX Futures Strategy ETF.

On May 1, 2018, the T. Rowe Price Media & Telecommunications Fund (PRMTX) will change its name to the T. Rowe Price Communications & Technology Fund. Price notes that the “investment universe available to the fund has evolved since the fund adopted its current name in 1997, and Internet-related securities now represent a much more significant portion of the fund’s holdings,” so the new name reflects an attempt to accurately reflect the current portfolio and strategy.

Effective on or about April 17, 2018, Touchstone Global Growth Fund (TGGAX, formerly DSM Global Growth Fund) will be renamed the Touchstone International Growth Opportunities Fund. At base, they’re eliminating their stake in U.S. stocks (over half of the portfolio) and reducing expenses by 10 bps. “There will be no other changes to the Fund,” they aver.

Value Line Income and Growth Fund has become Value Line Capital Appreciation Fund (VALIX). At base, they plan to lose the need for their “income” to be “as high and dependable as is consistent with reasonable risk and capital growth to increase total return” and downshift it to “income consistent with its asset allocation.”

To better coincide with its new investment objective and corresponding benchmark index, Vanguard REIT Index Fund (VGSIX) has changed its name to Vanguard Real Estate Index Fund

OFF TO THE DUSTBIN OF HISTORY

Thanks, as always, to The Shadow whose indefatigable sleuthing in the dark hallways of the SEC’s EDGAR database drags dozens of fund changes – most especially liquidations – to light each month. Even when I’ve already caught the changes, it’s incredibly reassuring to have him there … in the shadows … watching.

Thanks, as always, to The Shadow whose indefatigable sleuthing in the dark hallways of the SEC’s EDGAR database drags dozens of fund changes – most especially liquidations – to light each month. Even when I’ve already caught the changes, it’s incredibly reassuring to have him there … in the shadows … watching.

Both AB Asia ex-Japan Equity Portfolio (AXJAX) and AB Credit Long/Short Portfolio (ALASX) have closed and will liquidate on April 20, 2018. As you read on, you might notice that April 20, 2018 is the most popular date for liquidating one’s fund. (It probably has something to do with social media.)

Altegris Multi-Strategy Alternative Fund (MULNX) will liquidate on March 31, 2018.

Avenue Credit Strategies Fund (ACSAX) will be liquidated on March 14, 2018. If you know of ACSAX at all, it’s because of its tie to the spectacularly ill-fated Third Avenue Focused Credit Fund (TFCVX). Focused Credit trapped itself with such a spectacularly illiquid portfolio that it had to suspend all redemptions in December 2015 in order to relieve pressure as it is tried to liquidate itself. Two years later, TFCVX has been paying out dribs and drabs so that the current NAV is $0.51/share. They anticipate final liquidation this year, at which point Third Avenue shareholders will have received about 85% of their December 2015 account value back.

In any case, Avenue Credit Strategies was launched in 2012 by Jeffrey Gary, the founder manager of Focused Credit. Two things stand out about the first. First, he refuses to report the fund’s daily assets under management which is legal but very rare. One speculation is that he’s trying to confuse hedge fund traders who might otherwise be able to front-run his trades. Second, his trades don’t appear to have worked well enough that folks would want to copy them.

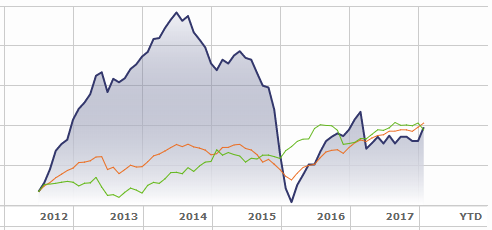

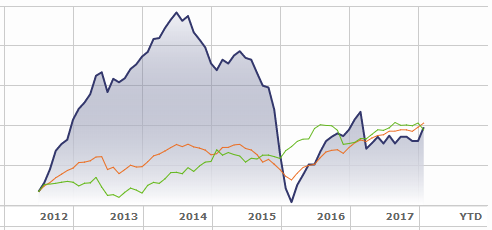

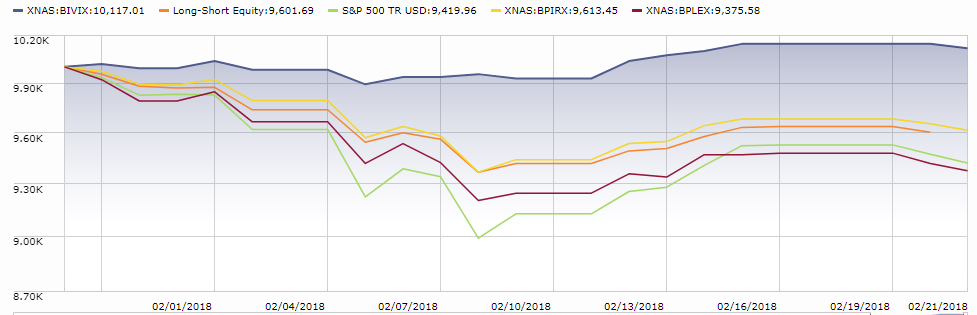

ACSAX is in blue while his boring long-short credit peers are in orange and the bond market aggregate is green.

BMO TCH Emerging Markets Bond Fund closed on February 8, 2018 and was, on short notice, liquidated. Similarly, the Class R3 share class of BMO Mid-Cap Value Fund and BMO Small-Cap Value Fund have been closed and will be liquidated.

The $2 million Bridgeway Small-Cap Momentum Fund (BRSMX) will liquidate on May 14, 2018.

CM Advisors Fund (CMAFX) merged into CM Advisors Small Cap Value Fund (CMOVX) on February 23, 2018. In an unnecessarily macabre note, the SEC filing designated CMOVX as “the Survivor Fund,” which rather brings a zombie apocalypse to mind. Others use the phrase “acquiring fund.”

Dreyfus Global Infrastructure Fund (DGANX) will liquidate on March 27, 2018.

Dreyfus Core Equity Fund (DLTSX), a clone of the no-load Dreyfus Appreciation Fund (DGAGX) is slated to merge into Dreyfus Worldwide Growth Fund (PGROX) on or about June 29, 2018. Why not merge into Appreciation? Because both Core and Worldwide carry sales loads.

Cohen & Steers Active Commodities Strategy Fund (CDFAX) will liquidate on April 13, 2018, if not sooner. (It’s rare that a Board allows that it might hurry up the execution, but here they did.)

The Trustees of Context Capital Funds have voted to liquidate and terminate Context Macro Opportunities Fund (CMOFX) effective on or about March 30, 2018.

On or about March 19, 2018, Equinox Crabel Strategy Fund (EQCRX) will “discontinue operations, close, liquidate and terminate.” It will pass its fifth anniversary on March 5, 2018, with a record of having lost money since inception and still having earned a three-star rating from Morningstar which tells you something about the managed futures peer group.

Equinox Systematica Macro Fund (EBCIX) is closing down. It’s another tiny managed futures fund with a losing record since inception. Final liquidation of the Fund is currently anticipated to occur on March 19, 2018.

“The Board of Trustees of Renaissance Capital Greenwich Funds has concluded that it is in the best interests of the Global IPO Fund (IPOSX) and its shareholders that the Fund be liquidated on or about March 28, 2018.” Yuh … the fund has been around since the late 1990s and has managed to return 1.9% per year which is identical to the return on the three-month T-bill over the same period. (The fund’s expense ratio – 2.5% – substantially exceeds its 20 year annual return.) The biggest difference: no money market fund has subjected itself to the 85% drawdown experienced by IPOSX investors.

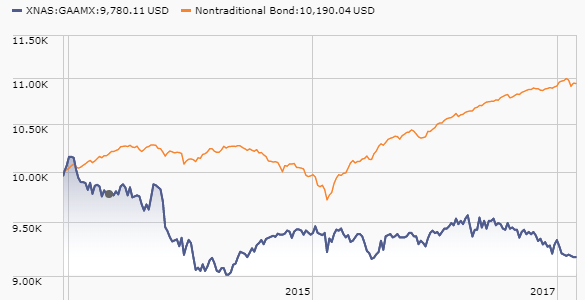

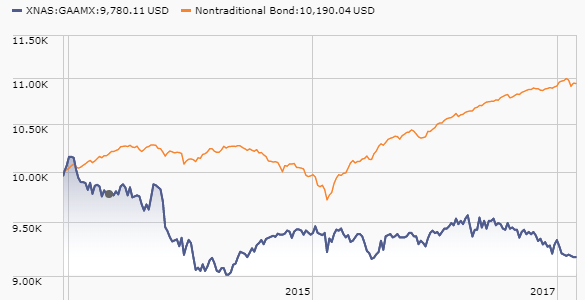

Goldman Sachs Strategic Macro Fund (GAAMX, formerly Goldman Sachs Fixed Income Macro Strategies Fund) was scheduled for liquidation on February 20, 2018 but the execution has now been delayed until about March 26, 2018. “The Liquidation Date may be further changed without notice at the discretion of the Trust’s officers.” Having checked the performance chart, I don’t think the delay is attributable to second thoughts on the Board’s part.

Around July 16, 2018, The Hartford Municipal Real Return Fund (HTNAX) merges into The Hartford Municipal Opportunities Fund (HHMAX).

Hartford Schroders Emerging Markets Debt and Currency Fund (SARVX) is expected to merge into Hartford Schroders Emerging Markets Multi-Sector Bond Fund (SMSVX). No date is set, but shareholders (baaaaa!) will be asked for their approval during a May 2018 proxy vote. The funds are pretty weakly correlated (0.74 from the inception of SARVX) but is should still be a pretty clear win for SARVX shareholders. They are moving into a less expensive fund whose three-year annual returns are 220% of their current fund’s while its volatility is only 130%.

Hartford Global Equity Income Fund (HLEAX) will be merging into Hartford International Equity Fund (HDVAX), assuming shareholder (baaaaa!) approval. The merger will occur on June 25, 2018.

HSBC Total Return Fund liquidated on February 28, 2018.

MassMutual Premier Value Fund (MCEAX) will be dissolved on or about March 23, 2018 (the “Termination Date”). “Will be dissolved” always strikes me as the fate of the intrepid spacefarers captured by the Xoraxian Empire.

Hurry to pay your last respects: Janus Henderson Real Return Fund (JURAX) liquidates on Friday, March 2, 2018.

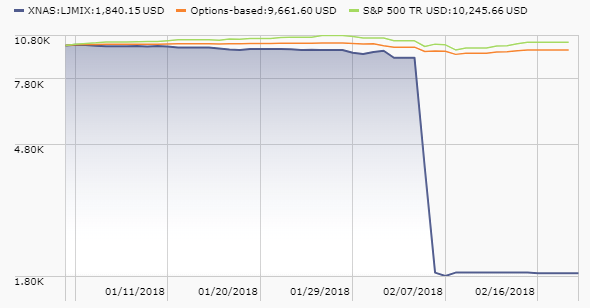

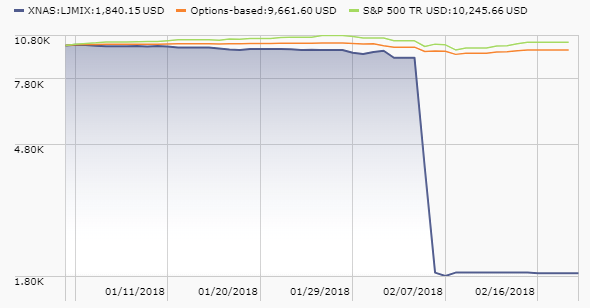

LJM Preservation and Growth Fund (LJMAX) closed to new investments on February 7, 2018 and will liquidate on March 29, 2018. Here’s a hint as to why:

Yuh, that would be rather more than an 80% repricing event there. Morningstar was “Neutral” on the fund until February 9, 2018, at which point they were officially “Negative.”

Manning & Napier Fund Quality Equity Series (MNQSX) will liquidate on March 9, 2018. No one will notice.

Neiman Tactical Income Fund (NTAFX) will undergo “orderly dissolution” on March 16, 2018.

Parnassus Asia Fund (PAFSX/PFPSX) will be liquidated on March 29, 2018.

Pear Tree Panagora Risk Parity Emerging Markets Fund (RPEMX/EMRPX) is merging into Pear Tree PanAgora Emerging Markets Fund (QFFOX), which “have identical investment objectives and substantially similar investment strategies” but “there will be an increase in fees for Risk Parity Fund shareholders.” Both funds badly trail their peers with the Risk-Parity fund offering one-third of its peers’ returns in exchange for a small reduction in short-term volatility. The reorganization will close on or about March 28, 2018.

In an announcement almost too dull to make, PNC has announced the liquidation of PNC Maryland Tax Exempt Bond Fund and PNC Ohio Intermediate Tax Exempt Bond Fund, both of which will close May 8 and liquidate June 8.

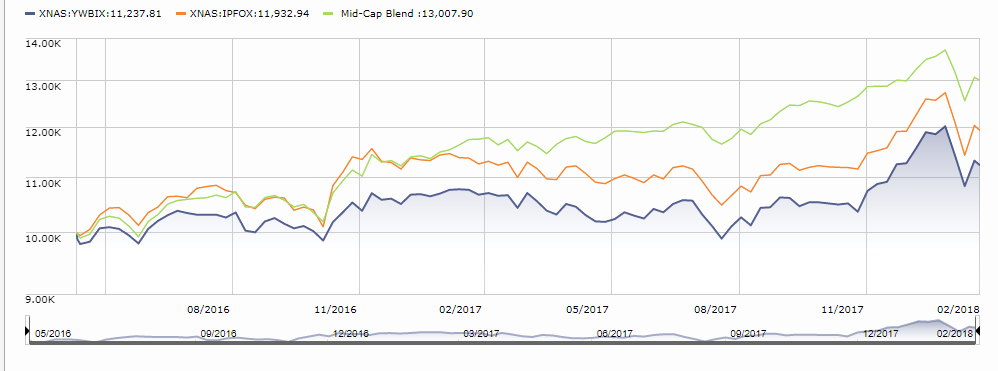

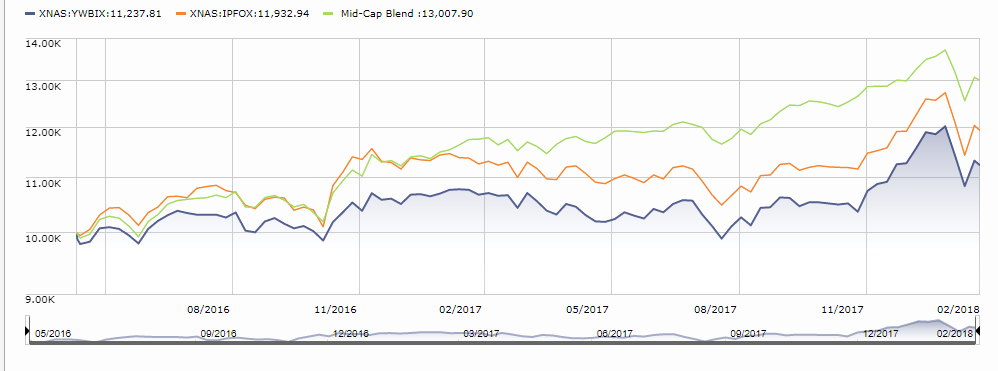

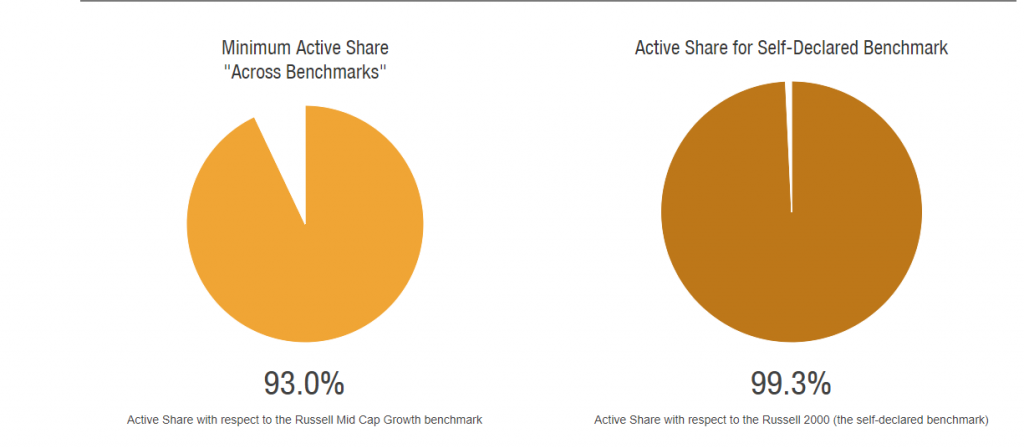

Folks at Poplar Forest Capital has announced the intention of merging Poplar Forest Outliers Fund (IPFOX) into Yorktown Mid Cap Fund (YWBIX) on April 20, 2018. The two funds’ “investment objectives, strategies, policies and a portfolio management team … are substantially similar,” which is to note that Poplar founder J. Dale Harvey runs both. The manager for Yorktown Mid Cap is Dale Harvey. He’s been the subadvisor for a year and the fund is two years old. It’s got $23 million and a 1.25% e.r. for “I” shares. The retail “A” shares for the Outliers fund was eliminated in November 2016. The remaining “I” class has $5 million and 1.1% expenses. Neither fund is covered in glory.

Green represents their Morningstar peer group, orange is Poplar and blue is Yorktown. The funds have a correlation of 0.88 and nearly identical short term Sharpe ratios.

The Schwab Money Market Fund (SWMXX) will liquidate on May 25, 2018. No idea of why.

SSGA High Yield Bond Fund (SSHGX) will liquidate on April 20, 2018.

Effective February 7, 2018, the Virtus Seix Limited Duration Fund was liquidated. The SEC filing explains that that means “the Fund has ceased to exist and is no longer available for sale. Accordingly, the Fund’s Prospectuses and SAI are no longer valid.”

WisdomTree has announced the liquidation of nine ETFs on or about March 16, 2018. The walking dead are:

- WisdomTree Strong Dollar Emerging Markets Equity Fund EMSD

- WisdomTree U.S. Domestic Economy Fund WUSA

- WisdomTree U.S. Export and Multinational Fund WEXP

- WisdomTree United Kingdom Hedged Equity Fund DXPS

- WisdomTree Global ex-U.S. Hedged Dividend Fund DXUS

- WisdomTree Japan Hedged Real Estate Fund DXJR

- WisdomTree Japan Hedged Capital Goods Fund DXJC

- WisdomTree Japan Hedged Health Care Fund DXJH

- WisdomTree Global ex-U.S. Hedged Real Estate Fund HDRW

I’m often a bit confused. Sometimes it’s as simple as the stuff in my pantry. Why, for instance, is cranberry sauce canned upside down? Look! The part you’ve supposed to open is on the bottom.

I’m often a bit confused. Sometimes it’s as simple as the stuff in my pantry. Why, for instance, is cranberry sauce canned upside down? Look! The part you’ve supposed to open is on the bottom. attacking the incumbent conservative governor. The ad had one woman thank the governor for paying for her many abortions, a gentleman in a dress for allowing them to use the women’s restroom, a white guy in a bandana thanked him for letting terrorists run free or some such. And the only response the governor could muster was to allege that the ad was bankrolled by Democratic politicians. Not that it was either (a) wrong or (b) repulsive, just that Democrats were somehow behind it. Uhhh … beyond the lack of evidence for the assertion, why would they bother? It’s very confusing.

attacking the incumbent conservative governor. The ad had one woman thank the governor for paying for her many abortions, a gentleman in a dress for allowing them to use the women’s restroom, a white guy in a bandana thanked him for letting terrorists run free or some such. And the only response the governor could muster was to allege that the ad was bankrolled by Democratic politicians. Not that it was either (a) wrong or (b) repulsive, just that Democrats were somehow behind it. Uhhh … beyond the lack of evidence for the assertion, why would they bother? It’s very confusing.

Which brings us to the one advantage that index funds offer, in addition to low costs. And that is, that the index is the index. No one is going to get an advantage in being able to purchase a unique investment idea. Dilbert, who often seems to have hidden cameras in many investment firms today put it best in his February 24/25 Calendar. Frame one has ASOK saying, “I followed your investment advice and lost all of my savings in the stock market.” Frame two has the CEO saying, “Did I mention that past performance is not an indication of future returns?” Frame three has ASOK asking, “Then how does ‘advice’ actually work?” In the same frame, the CEO replies, “It only works for the people that give it.”

Which brings us to the one advantage that index funds offer, in addition to low costs. And that is, that the index is the index. No one is going to get an advantage in being able to purchase a unique investment idea. Dilbert, who often seems to have hidden cameras in many investment firms today put it best in his February 24/25 Calendar. Frame one has ASOK saying, “I followed your investment advice and lost all of my savings in the stock market.” Frame two has the CEO saying, “Did I mention that past performance is not an indication of future returns?” Frame three has ASOK asking, “Then how does ‘advice’ actually work?” In the same frame, the CEO replies, “It only works for the people that give it.”

To help you examine some of the options, we started with the list of mutual funds and ETFs at the Forum for Sustainable and Responsible Investment.

To help you examine some of the options, we started with the list of mutual funds and ETFs at the Forum for Sustainable and Responsible Investment.

What does “invenomic” mean? Good question. It’s a term invented by Mr. Motamed to try to capture his investing philosophy. “Autonomic,” he notes, “derives from Greek words for ‘self’ and ‘a system of rules that govern a particular field’. ‘Invenomic’ reflects my conclusion that investing must be approached as a rules-governed activity.”

What does “invenomic” mean? Good question. It’s a term invented by Mr. Motamed to try to capture his investing philosophy. “Autonomic,” he notes, “derives from Greek words for ‘self’ and ‘a system of rules that govern a particular field’. ‘Invenomic’ reflects my conclusion that investing must be approached as a rules-governed activity.”

nclude Artisan High Income (top high income fund over three years), DoubleLine Shiller Enhanced CAPE (top LCV over three years), and Towle Deep Value Fund (top SCV over three).

nclude Artisan High Income (top high income fund over three years), DoubleLine Shiller Enhanced CAPE (top LCV over three years), and Towle Deep Value Fund (top SCV over three). Thanks, as always, to The Shadow whose indefatigable sleuthing in the dark hallways of the SEC’s EDGAR database drags dozens of fund changes – most especially liquidations – to light each month. Even when I’ve already caught the changes, it’s incredibly reassuring to have him there … in the shadows … watching.

Thanks, as always, to The Shadow whose indefatigable sleuthing in the dark hallways of the SEC’s EDGAR database drags dozens of fund changes – most especially liquidations – to light each month. Even when I’ve already caught the changes, it’s incredibly reassuring to have him there … in the shadows … watching.